40+ are property taxes included in mortgage

The property tax percentage. Ad Get a fixed-rate land loan with local service from Farm Credit.

Is A Reverse Mortgage A Hoax Know The Facts

Web Once you buy a home youre required to pay property taxes.

. Learn more about your property taxes and your mortgage. Lock Your Rate Today. Compare Apply Directly Online.

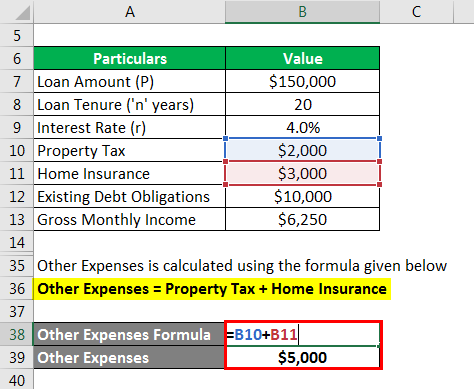

If youre unsure call your lender and ask. Web If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. Web The amount you owe in property taxes is fairly easy to calculate.

Web First if you have a down payment of less than 20 you wonât have enough equity in your home for your lender to consider allowing you to pay your property taxes. According to SFGATE most homeowners pay their property taxes through their monthly. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Web First if you have a down payment of less than 20 you wont have enough equity in your home for your lender to consider allowing you to pay your property taxes. Web Every month you pay a portion of your property taxes on top of your monthly mortgage payment and your lender usually saves up those payments in a separate. Call or apply online.

Your local governments tax rate and your propertys assessed value. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. In fact you may need to pay some at closing.

Get Instantly Matched With Your Ideal Mortgage Lender. All you have to do is take your. The Trusted Lender of 300000 Veterans and Military Families.

Web It should be included in escrow if thats how you set up your mortgage. Specifically they consist of the principal amount loan interest property tax. Web To illustrate lets say your annual property taxes are estimated at 3000 and you pay your mortgage in monthly installments.

Web Property taxes may be included in your mortgage payment or you may choose to pay them separately. Web WASHINGTON The Internal Revenue Service provided details today clarifying the federal tax status involving special payments made by 21 states in 2022. Web Principal interest taxes insurance are the sum components of a mortgage payment.

Web The amount you pay in property tax is based on two things. Form 1098 should report the real estate tax paid if thats the case. That means youd have to pay 250.

Depending on where you. Your first regular payment toward your property taxes. The assessed value of the home.

If you qualify for. Monthly quarterly semiannual or annual payments to meet your cash flow needs. Ad Compare the Best Home Loans for February 2023.

Apply Get Pre-Approved Today. Youll just need some information. Web Once youve paid off your mortgage the lender stops collecting and paying property tax on your behalf and the responsibility falls on you.

Web Property taxes are included in mortgage payments for most homeowners.

7104 40th Street Northwest Gig Harbor Wa 98335 Compass

Failure To Pay Property Taxes Is A Default Of Your Mortgage

40 Personal Financial Statement Templates Forms ᐅ Templatelab Personal Financial Statement Financial Statement Statement Template

Solved Assume That The Property Tax Bill On The Home You Chegg Com

Canadian Mortgage App Apps On Google Play

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield

19483 County 40 Park Rapids Mn 56470 Realtor Com

146 West Harbor Drive Palatka Fl 32177 Compass

Are Property Taxes Included In Mortgage Payments Sofi

The Advantages And Disadvantages Of Holding A Joint Title To Property With A Family Member Or Friend

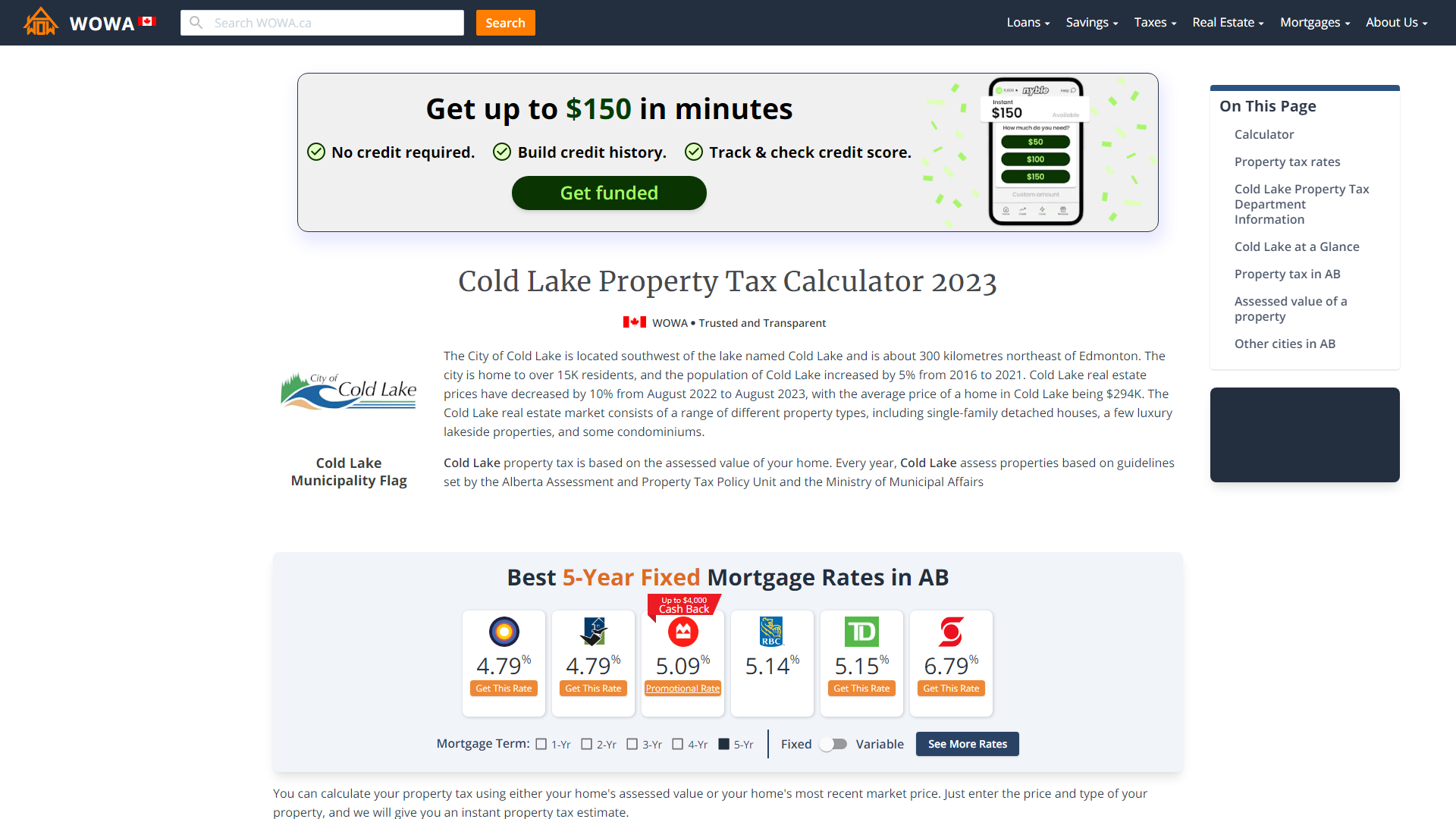

Cold Lake Property Tax 2022 Calculator Rates Wowa Ca

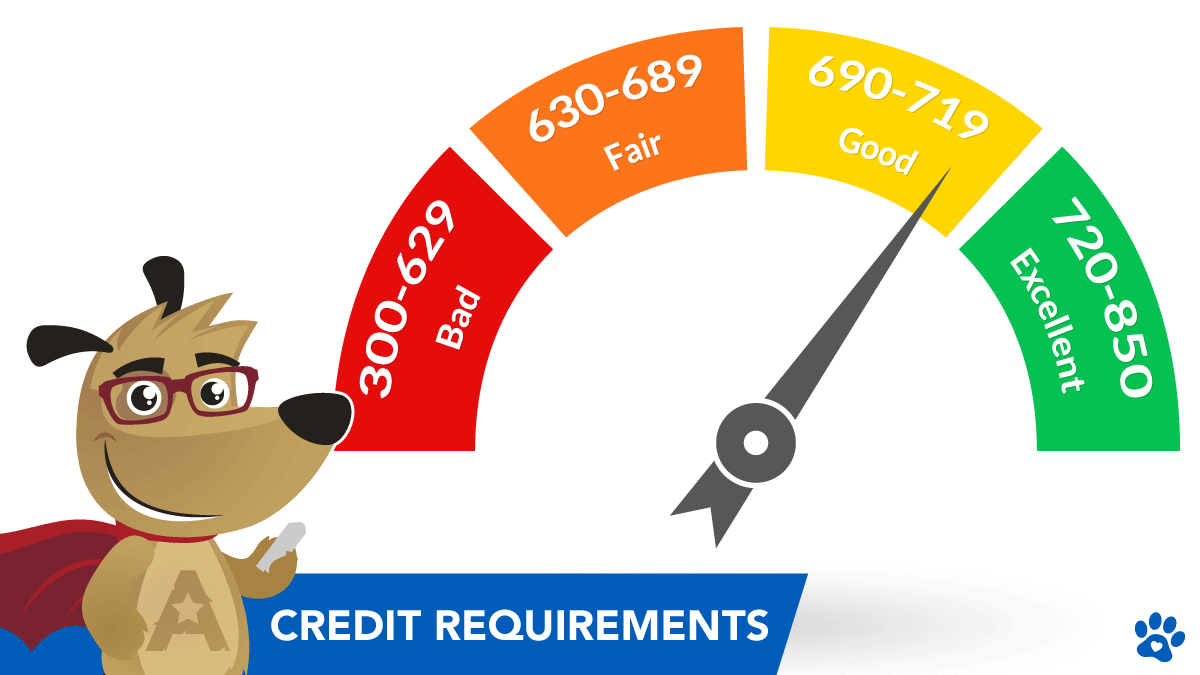

Credit Requirements For A Reverse Mortgage In 2023

How To Tell If Your Taxes Are Included In Your Mortgage Pdx Home Loan

40 Faqs On Auditing Auditors

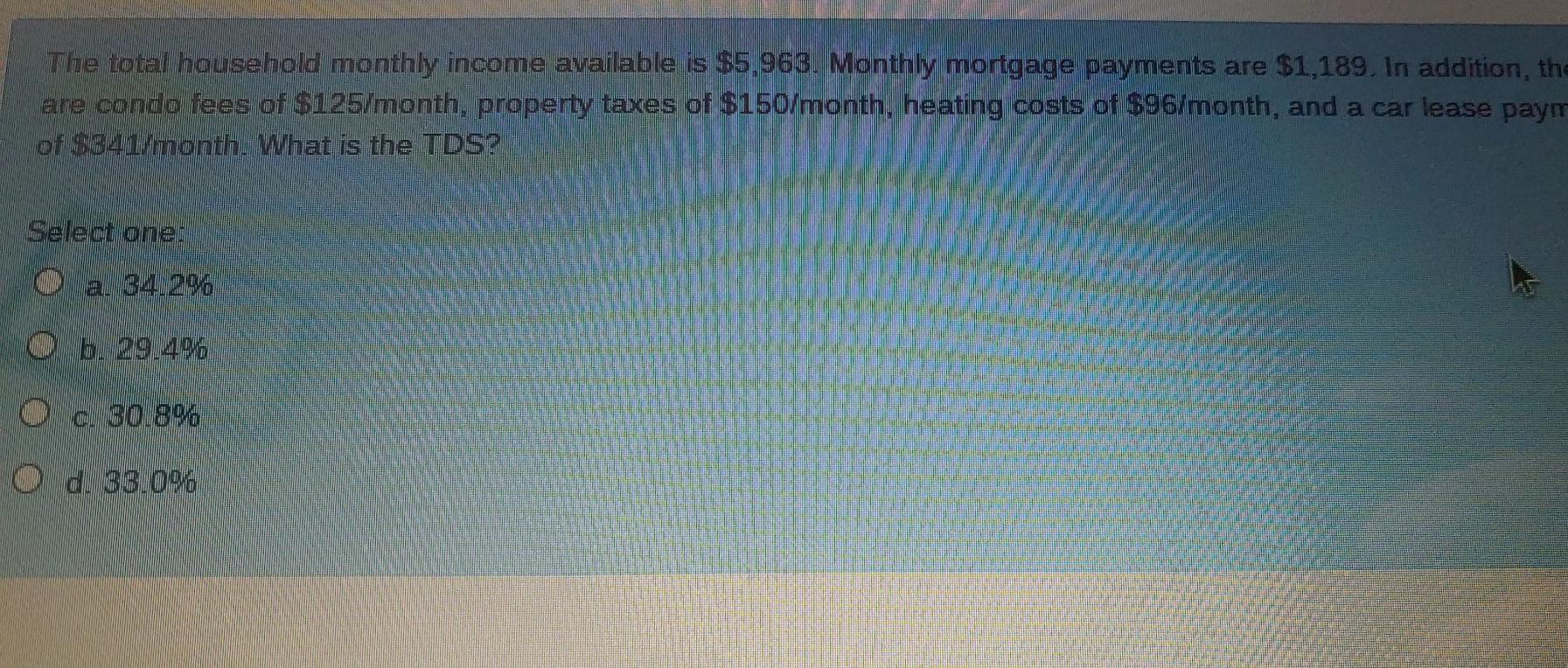

Total Debt Service Ratio Explanation And Examples With Excel Template

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

All About Property Taxes When Why And How Texans Pay